Featured

Table of Contents

Term life insurance coverage is a kind of plan that lasts a specific length of time, called the term. You select the length of the plan term when you initially obtain your life insurance policy. Maybe 5 years, two decades or even extra. If you die throughout the pre-selected term (and you have actually stayed on par with your costs), your insurer will certainly pay out a swelling amount to your nominated recipients.

Choose your term and your quantity of cover. Select the plan that's right for you., you know your costs will remain the very same throughout the term of the plan.

How much does Level Term Life Insurance For Seniors cost?

(However, you don't get any type of cash back) 97% of term life insurance cases are paid by the insurance business - ResourceLife insurance policy covers most situations of fatality, yet there will certainly be some exemptions in the terms of the plan. Exemptions may include: Hereditary or pre-existing problems that you fell short to divulge at the beginning of the policyAlcohol or drug abuseDeath while dedicating a crimeAccidents while participating in dangerous sportsSuicide (some policies exclude death by suicide for the very first year of the plan) You can add important ailment cover to your degree term life insurance policy for an additional cost.Critical illness cover pays a portion of your cover amount if you are identified with a serious disease such as cancer cells, cardiovascular disease or stroke.

Hereafter, the policy finishes and the surviving partner is no more covered. People commonly get joint plans if they have exceptional monetary dedications like a home mortgage, or if they have youngsters. Joint plans are normally more cost effective than solitary life insurance policy policies. Various other sorts of term life insurance plan are:Lowering term life insurance policy - The amount of cover lowers over the length of the policy.

This safeguards the purchasing power of your cover quantity against inflationLife cover is an excellent point to have because it offers economic protection for your dependents if the worst takes place and you die. Your enjoyed ones can likewise utilize your life insurance policy payout to spend for your funeral service. Whatever they choose to do, it's wonderful assurance for you.

Level term cover is terrific for fulfilling everyday living expenses such as home bills. You can also use your life insurance policy advantage to cover your interest-only home loan, settlement home mortgage, college costs or any various other financial obligations or continuous repayments. On the other hand, there are some downsides to degree cover, contrasted to other kinds of life policy.

Who offers flexible Level Term Life Insurance For Families plans?

Words "degree" in the phrase "degree term insurance policy" means that this sort of insurance coverage has a fixed premium and face amount (fatality advantage) throughout the life of the policy. Put simply, when individuals speak about term life insurance policy, they generally describe level term life insurance coverage. For most of people, it is the simplest and most cost effective option of all life insurance policy types.

Words "term" here describes an offered variety of years throughout which the level term life insurance stays active. Level term life insurance policy is just one of one of the most popular life insurance policy plans that life insurance companies supply to their clients because of its simplicity and price. It is also simple to contrast level term life insurance coverage quotes and obtain the finest premiums.

The device is as adheres to: To start with, choose a policy, death advantage quantity and policy duration (or term length). Choose to pay on either a monthly or annual basis. If your early demise happens within the life of the plan, your life insurance provider will pay a round figure of survivor benefit to your predetermined recipients.

What is included in Level Term Life Insurance Calculator coverage?

Your level term life insurance policy policy ends when you come to the end of your plan's term. At this point, you have the complying with choices: Choice A: Keep without insurance. This option matches you when you can insure by yourself and when you have no financial debts or dependents. Choice B: Buy a brand-new degree term life insurance policy plan.

FOR FINANCIAL PROFESSIONALS We have actually created to provide you with the most effective online experience. Your current web browser could limit that experience. You may be utilizing an old web browser that's in need of support, or settings within your web browser that are not suitable with our site. Please conserve yourself some disappointment, and update your browser in order to view our website.

How does Level Term Life Insurance For Families work?

Currently making use of an upgraded internet browser and still having difficulty? Please offer us a call at for more support. Your current browser: Finding ...

If the policy expires before your fatality or you live past the plan term, there is no payout. You may be able to renew a term policy at expiration, but the costs will certainly be recalculated based on your age at the time of revival. Term life is usually the the very least pricey life insurance policy readily available due to the fact that it offers a survivor benefit for a limited time and does not have a money value component like permanent insurance policy has.

Whole Life Insurance Coverage Fees 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 long-term life insurance coverage plan, for males and women in superb health.

What is Level Term Life Insurance Quotes?

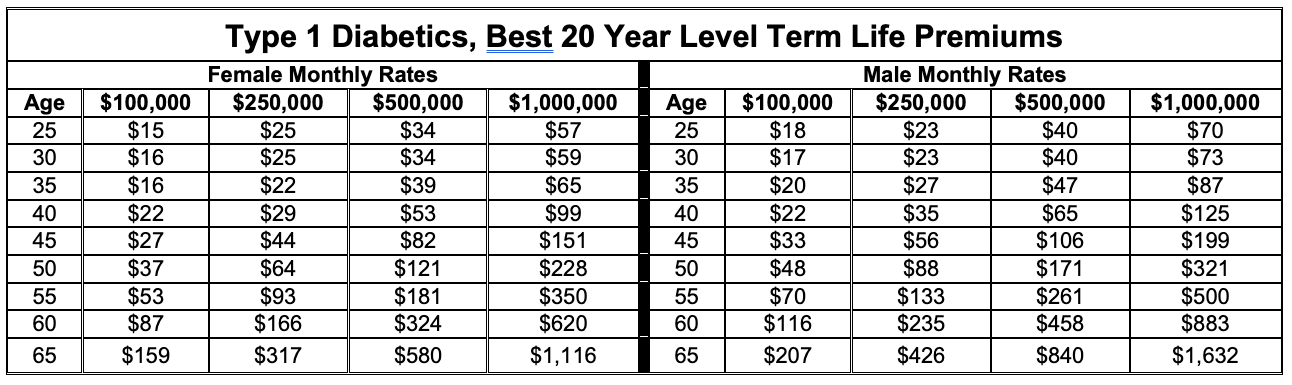

That reduces the overall threat to the insurance firm contrasted to a long-term life plan. The lowered danger is one aspect that allows insurers to charge lower costs. Rate of interest, the financials of the insurance policy firm, and state guidelines can likewise affect costs. As a whole, firms typically provide much better prices at the "breakpoint" protection degrees of $100,000, $250,000, $500,000, and $1,000,000.

Examine our recommendations for the ideal term life insurance policies when you prepare to buy. Thirty-year-old George wishes to secure his household in the not likely event of his very early death. He gets a 10-year, $500,000 term life insurance plan with a premium of $50 per month. If George dies within the 10-year term, the plan will certainly pay George's beneficiary $500,000.

If he lives and renews the policy after one decade, the premiums will be more than his first plan since they will certainly be based on his present age of 40 instead than 30. 30-year level term life insurance. If George is identified with a terminal illness throughout the first plan term, he probably will not be qualified to renew the policy when it expires

There are numerous types of term life insurance policy. The ideal choice will depend on your specific scenarios. The majority of term life insurance has a level premium, and it's the kind we have actually been referring to in most of this article.

Can I get Level Term Life Insurance online?

They might be a good choice for somebody that requires short-lived insurance policy. The insurance holder pays a taken care of, degree premium for the period of the plan.

Table of Contents

Latest Posts

What is What Does Level Term Life Insurance Mean? Find Out Here

What is Level Term Life Insurance Policy? All You Need to Know?

What Makes What Does Level Term Life Insurance Mean Different?

More

Latest Posts

What is What Does Level Term Life Insurance Mean? Find Out Here

What is Level Term Life Insurance Policy? All You Need to Know?

What Makes What Does Level Term Life Insurance Mean Different?