Featured

Table of Contents

Nevertheless, keeping every one of these phrases and insurance coverage kinds right can be a frustration - can you use life insurance to buy a house. The complying with table puts them side-by-side so you can rapidly distinguish amongst them if you obtain puzzled. Another insurance protection type that can pay off your mortgage if you pass away is a typical life insurance coverage plan

A is in location for a set number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away during that term. A gives insurance coverage for your entire life span and pays out when you pass away.

One usual guideline is to aim for a life insurance coverage policy that will certainly pay out approximately 10 times the insurance holder's income amount. Additionally, you might pick to use something like the dollar method, which adds a family's financial obligation, income, home loan and education expenditures to calculate how much life insurance policy is required (loans protection).

There's a reason new home owners' mail boxes are typically bombarded with "Last Chance!" and "Urgent! Activity Needed!" letters from home mortgage security insurance firms: Several only permit you to acquire MPI within 24 months of shutting on your home mortgage. It's also worth noting that there are age-related limits and thresholds enforced by nearly all insurance firms, that typically won't give older buyers as several alternatives, will certainly charge them more or might reject them outright.

Below's how mortgage defense insurance measures up versus typical life insurance. If you're able to certify for term life insurance coverage, you must avoid home mortgage protection insurance (MPI).

In those circumstances, MPI can give excellent peace of mind. Every mortgage protection alternative will certainly have various regulations, policies, benefit alternatives and downsides that need to be evaluated very carefully versus your accurate situation.

Mortgage Claims Reviews

A life insurance policy policy can aid pay off your home's home loan if you were to pass away. It is among lots of means that life insurance may aid safeguard your liked ones and their financial future. Among the ideal methods to factor your mortgage right into your life insurance policy need is to talk with your insurance coverage agent.

Rather than a one-size-fits-all life insurance policy plan, American Domesticity Insurance policy Company offers policies that can be created especially to fulfill your family members's demands. Below are several of your alternatives: A term life insurance coverage policy. home insurance for loan is energetic for a particular quantity of time and typically provides a bigger amount of insurance coverage at a lower rate than a long-term plan

Rather than just covering a set number of years, it can cover you for your entire life. It likewise has living benefits, such as money worth accumulation. * American Household Life Insurance coverage Company supplies different life insurance coverage plans.

Your representative is a great resource to answer your inquiries. They may also be able to assist you locate voids in your life insurance policy protection or brand-new ways to save money on your other insurance coverage. ***Yes. A life insurance coverage beneficiary can choose to make use of the death benefit for anything - life insurance quote for mortgage. It's a wonderful method to assist protect the economic future of your household if you were to die.

Life insurance policy is one way of aiding your household in settling a home loan if you were to die before the mortgage is totally settled. No. Life insurance coverage is not required, but it can be a vital part of aiding see to it your loved ones are monetarily protected. Life insurance policy proceeds may be utilized to assist repay a mortgage, however it is not the like mortgage insurance coverage that you may be required to have as a condition of a lending.

Insurance To Pay Mortgage If Unemployed

Life insurance policy might assist guarantee your residence stays in your family members by providing a survivor benefit that might assist pay down a home loan or make important acquisitions if you were to die. Contact your American Family members Insurance coverage representative to discuss which life insurance coverage policy best fits your demands. This is a short summary of protection and is subject to plan and/or motorcyclist terms and conditions, which may vary by state.

The words lifetime, long-lasting and permanent are subject to policy conditions. * Any type of lendings extracted from your life insurance plan will accumulate passion. mortgage insurance lost job. Any kind of exceptional financing balance (lending plus rate of interest) will certainly be deducted from the survivor benefit at the time of claim or from the cash money worth at the time of surrender

** Based on plan conditions. ***Price cuts might vary by state and business underwriting the automobile or home owners policy. Price cuts might not apply to all coverages on a car or house owners policy. Discount rates do not relate to the life policy. Plan Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage security insurance (MPI) is a different kind of guard that might be handy if you're unable to settle your home mortgage. Home mortgage defense insurance policy is an insurance coverage policy that pays off the rest of your mortgage if you pass away or if you come to be impaired and can't function.

Like PMI, MIP secures the loan provider, not you. However, unlike PMI, you'll pay MIP for the period of the lending term, in many cases. Both PMI and MIP are called for insurance coverage coverages. An MPI plan is totally optional. The quantity you'll spend for home mortgage defense insurance policy depends upon a selection of variables, consisting of the insurance provider and the current equilibrium of your home mortgage.

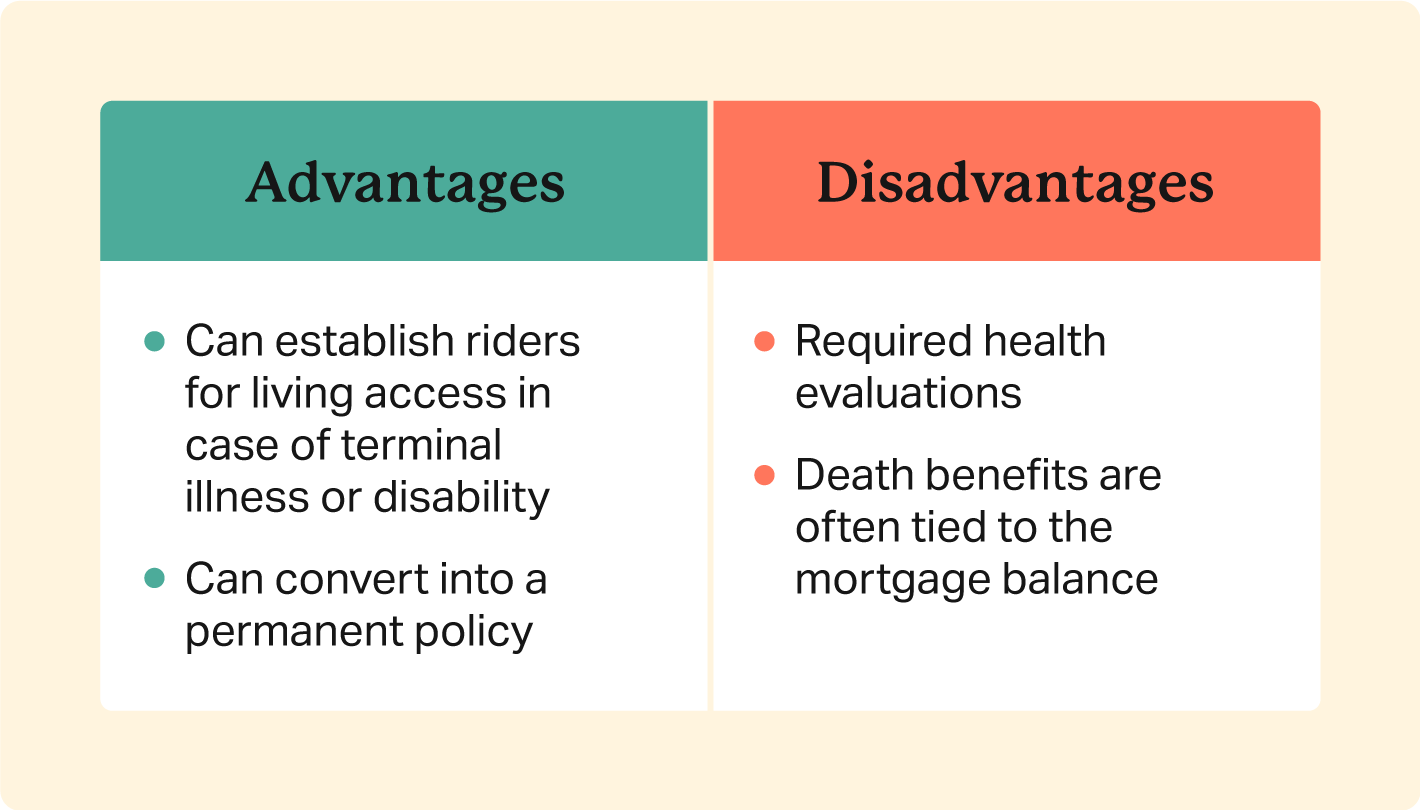

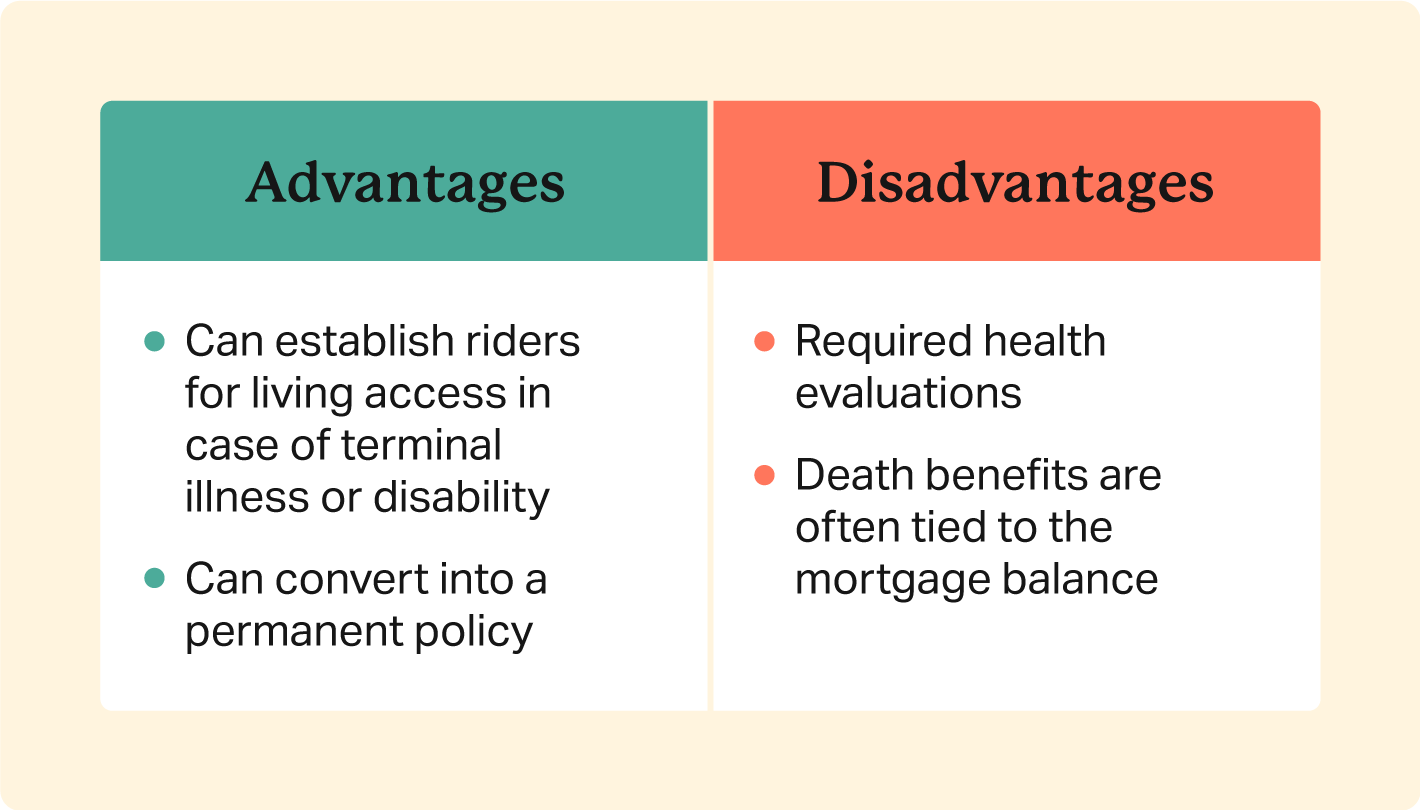

Still, there are pros and disadvantages: Most MPI policies are issued on a "ensured acceptance" basis. That can be beneficial if you have a wellness condition and pay high rates permanently insurance policy or battle to acquire insurance coverage. who is my mortgage insurance company. An MPI plan can offer you and your family with a complacency

Mortgage Protection Life & Critical Illness Insurance

You can choose whether you need home loan defense insurance and for exactly how lengthy you need it. You may want your home mortgage security insurance term to be close in length to just how long you have actually left to pay off your home loan You can terminate a home mortgage security insurance coverage plan.

Latest Posts

Whole Life Insurance Instant Quote

Best Final Expense Insurance Companies

Instant Online Quote For Life Insurance