Featured

Table of Contents

- – Who provides the best Level Term Life Insuranc...

- – What is the process for getting Level Term Lif...

- – How do I choose the right Level Term Life Ins...

- – How can Level Term Life Insurance Quotes prot...

- – What should I look for in a Level Term Life ...

- – What is the best Tax Benefits Of Level Term ...

Degree term life insurance policy is just one of the most inexpensive insurance coverage options on the market due to the fact that it provides fundamental security in the form of survivor benefit and only lasts for a set amount of time. At the end of the term, it expires. Entire life insurance policy, on the various other hand, is significantly extra expensive than level term life due to the fact that it does not expire and comes with a money value attribute.

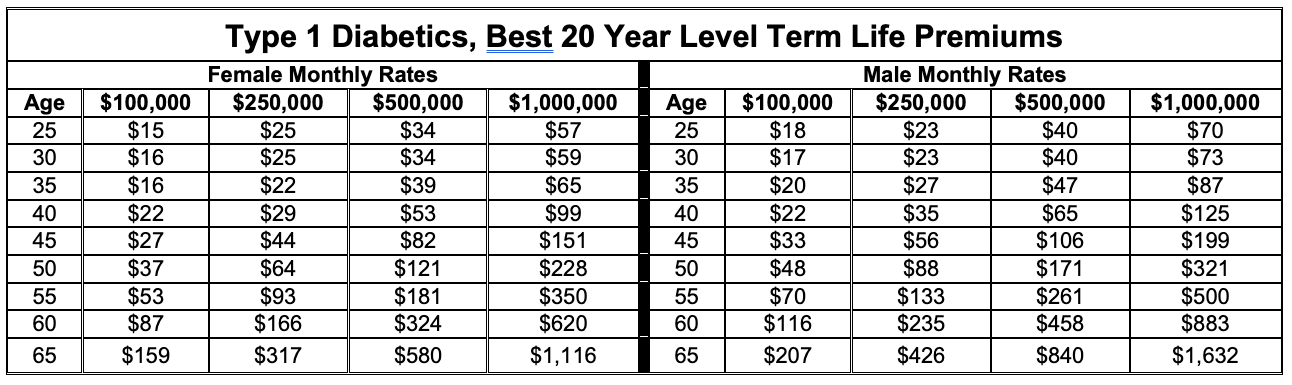

Prices might differ by insurer, term, coverage amount, health class, and state. Level term is a wonderful life insurance option for most individuals, yet depending on your protection demands and personal situation, it could not be the best fit for you.

Who provides the best Level Term Life Insurance Rates?

Annual renewable term life insurance policy has a term of only one year and can be renewed each year. Yearly sustainable term life costs are at first less than degree term life costs, but rates increase each time you renew. This can be a good option if you, as an example, have simply stop cigarette smoking and need to wait two or three years to request a level term plan and be qualified for a reduced rate.

, your death advantage payment will certainly reduce over time, yet your repayments will remain the exact same. On the other hand, you'll pay more upfront for less coverage with an increasing term life policy than with a level term life plan. If you're not certain which type of plan is best for you, working with an independent broker can assist.

What is the process for getting Level Term Life Insurance Calculator?

As soon as you've made a decision that degree term is best for you, the next step is to acquire your plan. Below's just how to do it. Compute just how much life insurance policy you require Your coverage amount ought to attend to your family's long-lasting monetary demands, consisting of the loss of your income in the event of your death, along with financial debts and daily expenditures.

As you search for means to secure your monetary future, you've most likely come throughout a wide range of life insurance policy alternatives. Selecting the best protection is a big decision. You desire to locate something that will certainly help support your enjoyed ones or the reasons essential to you if something happens to you.

Lots of people lean towards term life insurance policy for its simplicity and cost-effectiveness. Term insurance agreements are for a fairly short, specified amount of time yet have choices you can customize to your demands. Certain advantage alternatives can make your costs alter over time. Degree term insurance, however, is a kind of term life insurance policy that has constant repayments and an imperishable.

How do I choose the right Level Term Life Insurance Protection?

Degree term life insurance policy is a subset of It's called "level" since your costs and the benefit to be paid to your enjoyed ones stay the exact same throughout the contract. You won't see any type of modifications in price or be left asking yourself about its value. Some contracts, such as yearly eco-friendly term, may be structured with costs that raise gradually as the insured ages.

Dealt with death advantage. This is additionally established at the start, so you can know specifically what fatality benefit amount your can expect when you die, as long as you're covered and up-to-date on costs.

How can Level Term Life Insurance Quotes protect my family?

This commonly between 10 and 30 years. You accept a set costs and fatality benefit throughout of the term. If you die while covered, your fatality advantage will certainly be paid out to loved ones (as long as your costs are up to day). Your recipients will understand in advance how a lot they'll obtain, which can aid for planning purposes and bring them some economic safety.

You might have the option to for one more term or, more probable, restore it year to year. If your agreement has an ensured renewability stipulation, you might not require to have a new medical examination to keep your insurance coverage going. However, your costs are likely to raise because they'll be based on your age at renewal time. 20-year level term life insurance.

With this alternative, you can that will certainly last the remainder of your life. In this case, once again, you may not need to have any kind of brand-new medical examinations, but costs likely will increase as a result of your age and brand-new protection. Various firms offer numerous alternatives for conversion, be certain to recognize your selections prior to taking this step.

Many term life insurance is level term for the duration of the agreement duration, but not all. With reducing term life insurance coverage, your fatality advantage goes down over time (this kind is typically taken out to particularly cover a long-lasting financial debt you're paying off).

What should I look for in a Level Term Life Insurance Policy plan?

And if you're established up for renewable term life, after that your costs likely will go up every year. If you're checking out term life insurance coverage and wish to make sure simple and foreseeable economic defense for your family, degree term may be something to take into consideration. Nonetheless, similar to any kind of protection, it may have some limitations that do not meet your demands.

Commonly, term life insurance policy is a lot more budget-friendly than irreversible coverage, so it's an affordable means to secure financial protection. Flexibility. At the end of your agreement's term, you have several choices to continue or go on from coverage, often without needing a medical test. If your budget plan or insurance coverage requires modification, death advantages can be decreased with time and cause a lower costs.

What is the best Tax Benefits Of Level Term Life Insurance option?

As with various other kinds of term life insurance policy, as soon as the agreement finishes, you'll likely pay greater costs for coverage because it will certainly recalculate at your current age and health and wellness. Level term offers predictability.

Yet that does not indicate it's a suitable for everybody. As you're buying life insurance, right here are a couple of crucial elements to think about: Spending plan. Among the advantages of level term protection is you understand the expense and the death benefit upfront, making it easier to without stressing over increases gradually.

Typically, with life insurance, the much healthier and younger you are, the a lot more affordable the coverage. Your dependents and financial duty play a function in determining your coverage. If you have a young family members, for instance, level term can assist supply monetary support throughout essential years without paying for coverage much longer than needed.

Table of Contents

- – Who provides the best Level Term Life Insuranc...

- – What is the process for getting Level Term Lif...

- – How do I choose the right Level Term Life Ins...

- – How can Level Term Life Insurance Quotes prot...

- – What should I look for in a Level Term Life ...

- – What is the best Tax Benefits Of Level Term ...

Latest Posts

What is What Does Level Term Life Insurance Mean? Find Out Here

What is Level Term Life Insurance Policy? All You Need to Know?

What Makes What Does Level Term Life Insurance Mean Different?

More

Latest Posts

What is What Does Level Term Life Insurance Mean? Find Out Here

What is Level Term Life Insurance Policy? All You Need to Know?

What Makes What Does Level Term Life Insurance Mean Different?